2024-10-17

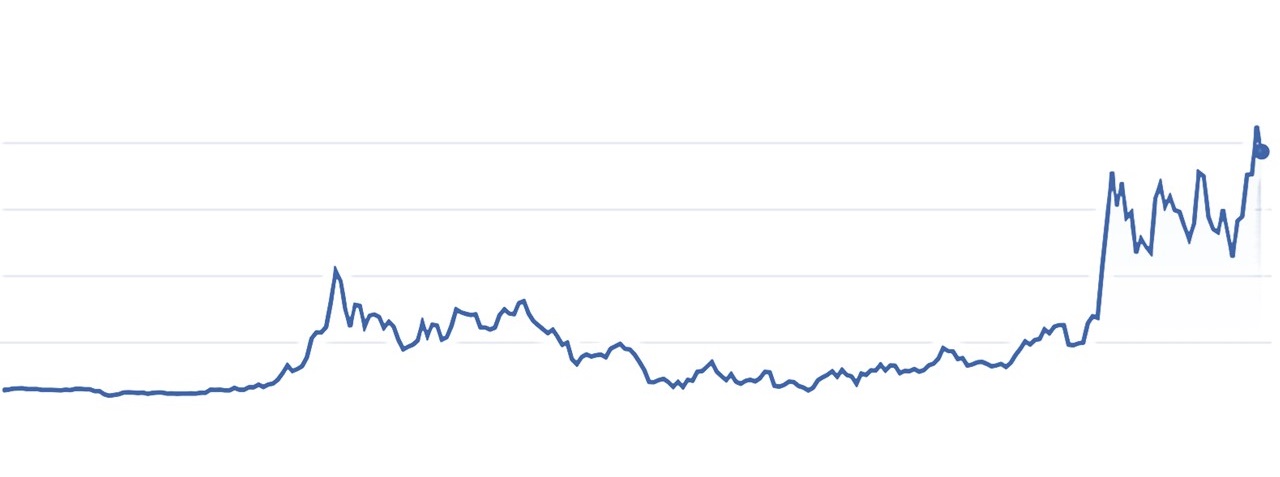

MicroStrategy stock surges over 1,000% since 2020, outperforming S&P 500. MicroStrategy, one of the first

publicly traded companies to add Bitcoin to its balance sheet, has seen its

stock skyrocket by 1,078% over the past four years.

From October 16, 2020, to October 16,

2024, MicroStrategy's stock price surged from $16.47 to $194.09, outpacing many

super performance leadership stocks . During the same period, the S&P 500

index rose by just 67.7%.

The company's decision to begin

purchasing Bitcoin in 2020 has proven to be a major driver of its stock’s

growth.

MicroStrategy Incorporated (ticker

symbol: MSTR) is a publicly traded company on the Nasdaq stock exchange.

It is a business intelligence (BI), software, and cloud-based service provider.

The company is known for offering analytics and business intelligence

platforms, allowing enterprises to analyze data and make strategic decisions

based on insights. However, in recent years, MicroStrategy has become

particularly notable for its investments in Bitcoin.

Here’s a breakdown of MicroStrategy and

its stock (MSTR):

1. Business Intelligence Software

Core Business:

MicroStrategy's primary business revolves around providing business analytics

software. It helps organizations harness data to make better decisions,

utilizing tools for reporting, data visualization, and analytics.

Key Clients: Its products

are used by enterprises across various industries, including banking, retail,

and telecommunications.

2. Bitcoin Investments

Shift in Focus: Starting in

2020, MicroStrategy began investing heavily in Bitcoin as a strategy to

preserve shareholder value. CEO Michael Saylor has been an outspoken

advocate for Bitcoin as a hedge against inflation.

Massive Bitcoin Holdings: As of recent

reports, MicroStrategy holds billions of dollars worth of Bitcoin. The company

has used both its own capital and issued debt to buy more of the

cryptocurrency. Its stock price (MSTR) has become highly correlated with the

price of Bitcoin due to these substantial holdings.

MicroStrategy's financial performance,

particularly its revenue from 2019 to 2024, reflects its transition from a

traditional business intelligence company to one heavily invested in Bitcoin.

As of September 20, 2024, MicroStrategy holds 252,220 BTC acquired for $9.9

billion at $39,266 per Bitcoin.

2019: The company reported $486.33 million in revenue, a slight decrease of 2.27% from the previous year, reflecting stagnant growth in its core business.

2020: Revenue dropped to $480.74 million, a decrease of 1.15% year-over-year. During this period, MicroStrategy began its significant investment in Bitcoin, which would later affect its financial profile.

2021: Revenue increased to $510.76 million, a 6.25% rise from 2020. This uptick marked a positive turn in business performance, coinciding with the rise of Bitcoin, which greatly influenced investor sentiment.

2022: Revenue was $499.26 million, a slight decline of 2.25%, even though the company continued its heavy Bitcoin acquisition strategy.

2023: The company posted $496.26 million in revenue, reflecting a 0.6% decline. Despite the stable revenue, the company's Bitcoin holdings led to increased market volatility in its stock.

2024 (First Half): Revenue continued

its downward trend, with $480.63 million over the trailing 12 months,

representing a decline of 3.92% year-over-year.

MicroStrategy's performance has

surpassed every company in the S&P 500 index since 2020, fueling market

expectations for further bullish momentum. As a result, investors remain

optimistic about the company's future trajectory, particularly given its strong

ties to the ongoing rise of cryptocurrency market.