2025-05-08

Ethereum has activated its most important network overhaul since the 2022 Merge, launching the

long-anticipated “Pectra” upgrade on May 7 at 10:05 UTC.

The hard fork, named after a blend of

“Prague” and “Electra,” introduces sweeping changes aimed at improving staking

flexibility, wallet usability, and blockchain efficiency.

After nearly 18 months in development

and two failed testnet trials, the upgrade went live on Ethereum’s mainnet and

finalized within 13 minutes.

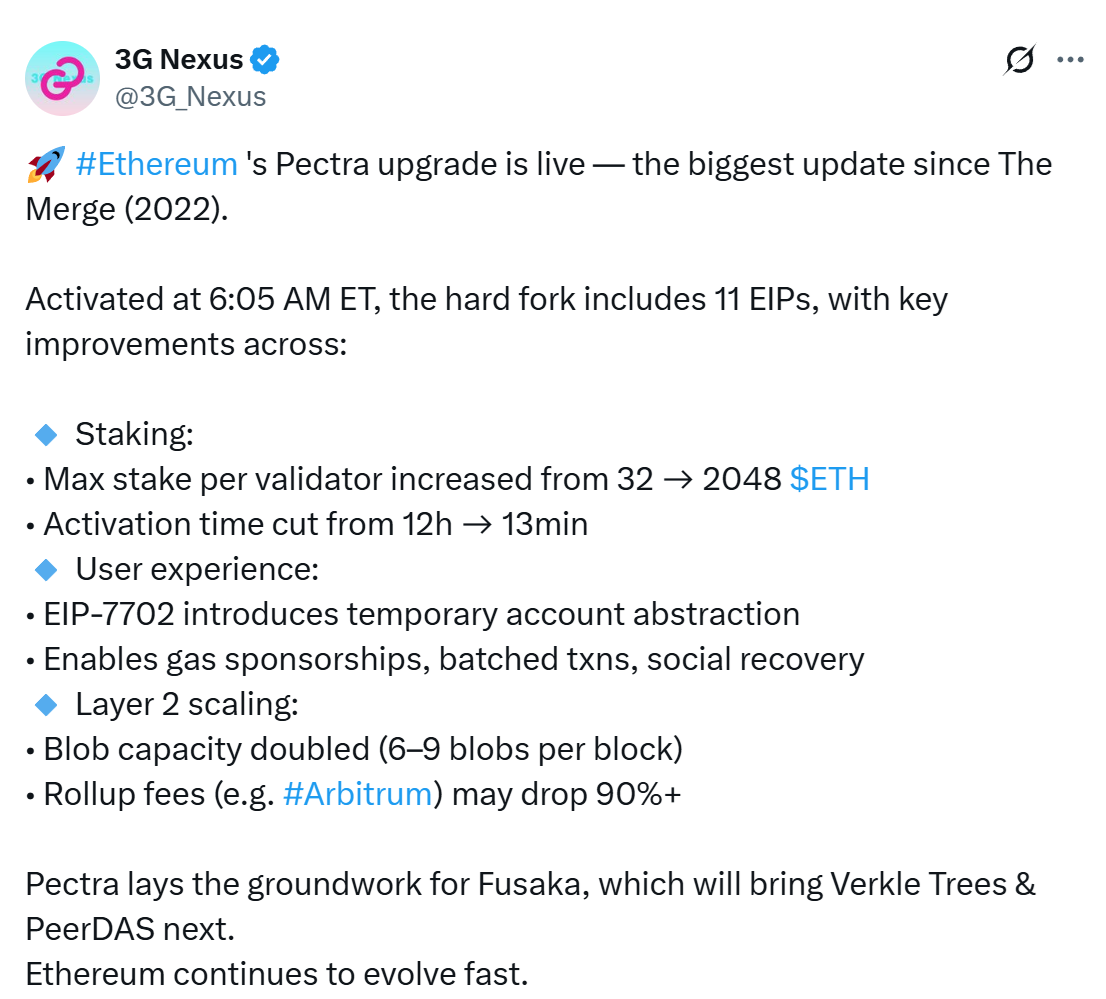

3G Nexus on X: "🚀 #Ethereum 's Pectra upgrade is live — the biggest update since The Merge (2022).

Key Features: Smart Wallets and Bigger

Stakes

Two main Ethereum Improvement Proposals

(EIPs) define the Pectra upgrade:

EIP-7702 brings account

abstraction a step closer to reality. It enables regular Ethereum wallets to

temporarily act like smart contracts.

That means users could soon batch

multiple actions, pay gas fees in stablecoins, or recover lost wallets, features

long viewed as critical to mainstream adoption.

EIP-7251 raises the

maximum stake per validator from 32 ETH to 2,048 ETH, a move designed to ease

infrastructure demands on large staking providers. This allows validators to

consolidate rather than spin up hundreds of separate nodes, reducing

operational costs and freeing up space in the queue for new participants.

“This means small operators can

compound their stake directly, while large ones can consolidate validators to

reduce bandwidth use,” said Tim Beiko, Ethereum Foundation protocol lead.

Until now, staking large sums of ETH

required complex validator setups, often split across dozens—or hundreds—of

nodes. The new 2,048 ETH limit is expected to simplify participation,

particularly for institutions, and potentially strengthen the network’s

decentralization and security.

Interest in Ethereum staking has surged

since 2024. Analysts see Pectra as a catalyst for more institutional inflows,

especially as Ethereum competes with faster-moving rivals like Solana.

Beyond staking and smart accounts, the

Pectra upgrade includes nine additional EIPs targeting validator efficiency,

cryptographic operations, and scalability:

EIP-7691 doubles

Ethereum’s blob throughput, enhancing Layer 2 performance and reducing fees for

users on rollups.

EIP-7002 improves

validator withdrawal security.

EIP-2537 and EIP-2935

boost cryptographic speed and data accessibility, aiding privacy and

verification tools.

Despite the technical leap, markets

barely reacted, likely because the upgrade had been priced in. Ethereum’s last

major rally occurred in late April.

Still, Pectra lands at a delicate time.

Ethereum has steadily lost market share to faster and more developer-friendly

chains.

The Ethereum Foundation recently

introduced new leadership and plans to re-energize its ecosystem.

This upgrade could be the start of a

reset. By fixing long-standing friction points and easing institutional access,

Ethereum aims to solidify its lead as the premier smart contract platform.

While not as dramatic as the switch to

proof-of-stake, Pectra might prove more consequential in the long run. It

tackles real-world usability, scalability, and infrastructure bottlenecks.