2024-11-13

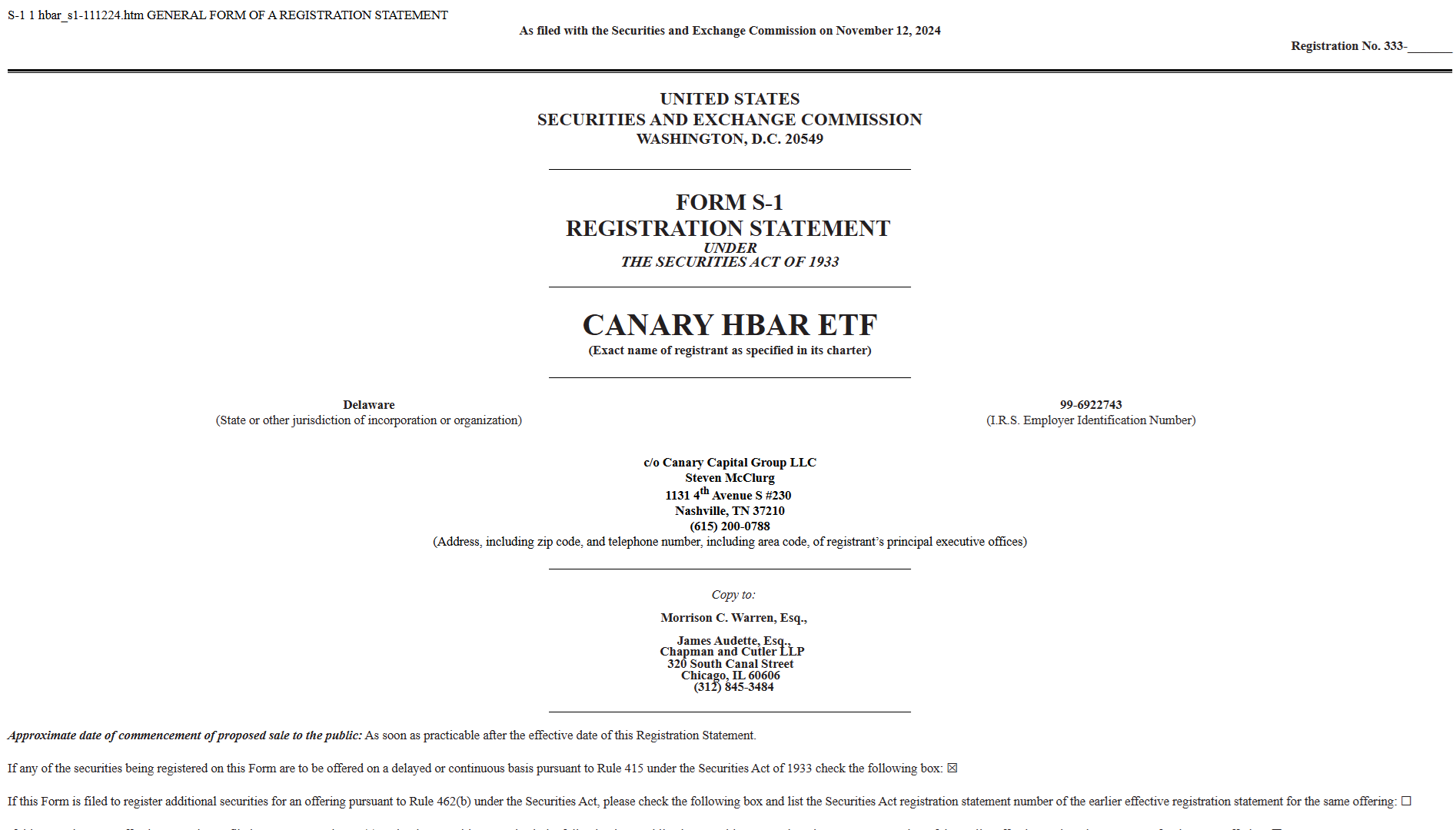

On November 12, 2024, Canary Capital has filed an S-1

registration statement with the U.S. Securities and Exchange Commission (SEC)

for a spot exchange-traded fund (ETF) focused on Hedera's native token, HBAR.

This marks the first-ever application

for a spot HBAR ETF, aiming to provide investors with direct exposure to HBAR

without using derivatives or futures contracts.

The filing highlights that the ETF will

hold HBAR tokens directly, offering a purer play on Hedera's value. However,

key details like the fund's custodian and administrator are yet to be named.

www.sec.gov/Archives/edgar/data/2039458/000199937124014510/hbar_s1-111224.htm

Hedera Hashgraph (HBAR) is a public

distributed ledger that uses a unique consensus mechanism known as the

Hashgraph consensus algorithm. Unlike traditional blockchain technologies, such

as Bitcoin or Ethereum, Hedera Hashgraph employs a directed acyclic graph (DAG)

structure for its data processing.

This allows it to achieve high

throughput, low latency, and fairness in transaction ordering.

HBAR is used as both a utility token

and a means to incentivize and secure the network.

Network Fees: HBAR pays for

transactions and smart contract execution on the Hedera network.

Staking and Security: HBAR holders

can stake tokens to help secure the network.

Micropayments: Due to its low

fees and high speed, HBAR is ideal for microtransactions.

HBAR Supply: The total

supply of HBAR is fixed at 50 billion tokens, ensuring scarcity over time.