2023-10-09

Radiant Capital is a lending and

borrowing platform. Users can earn interest by depositing crypto assets on the

platform. Radiant Capital currently supports Arbitrum and BNB Chain. It will be expanding to Ethereum mainnet on October 15, 2023.

Radiant Capital is a cross-chain DeFi

lending protocol. It uses LayerZero to facilitate cross-chain lending.

Users can deposit collateral on

Arbitrum and borrow on BNB Chain and vice versa. Users are required to deposit

assets on one chain to become a dynamic liquidity provider (dLP), then they can

borrow assets on another chain.

RDNT Token

RDNT is the native token of the Radiant

Capital. It has max supply of 1,000,000,000 RDNT.

RDNT uses for governance

which allow token holders to vote on improvement proposals.

Another utility of RDNT uses for

staking and revenue sharing. Users that provide dynamic liquidity providers

(dLP). They can lock dLP tokens to receive RDNT emissions on their deposits or

borrow as well as receive shares from fees generate from blue-chip assets such as Bitcoin, Ethereum, BNB, and

stablecoins through borrowing interest, flash loans, and liquidations.

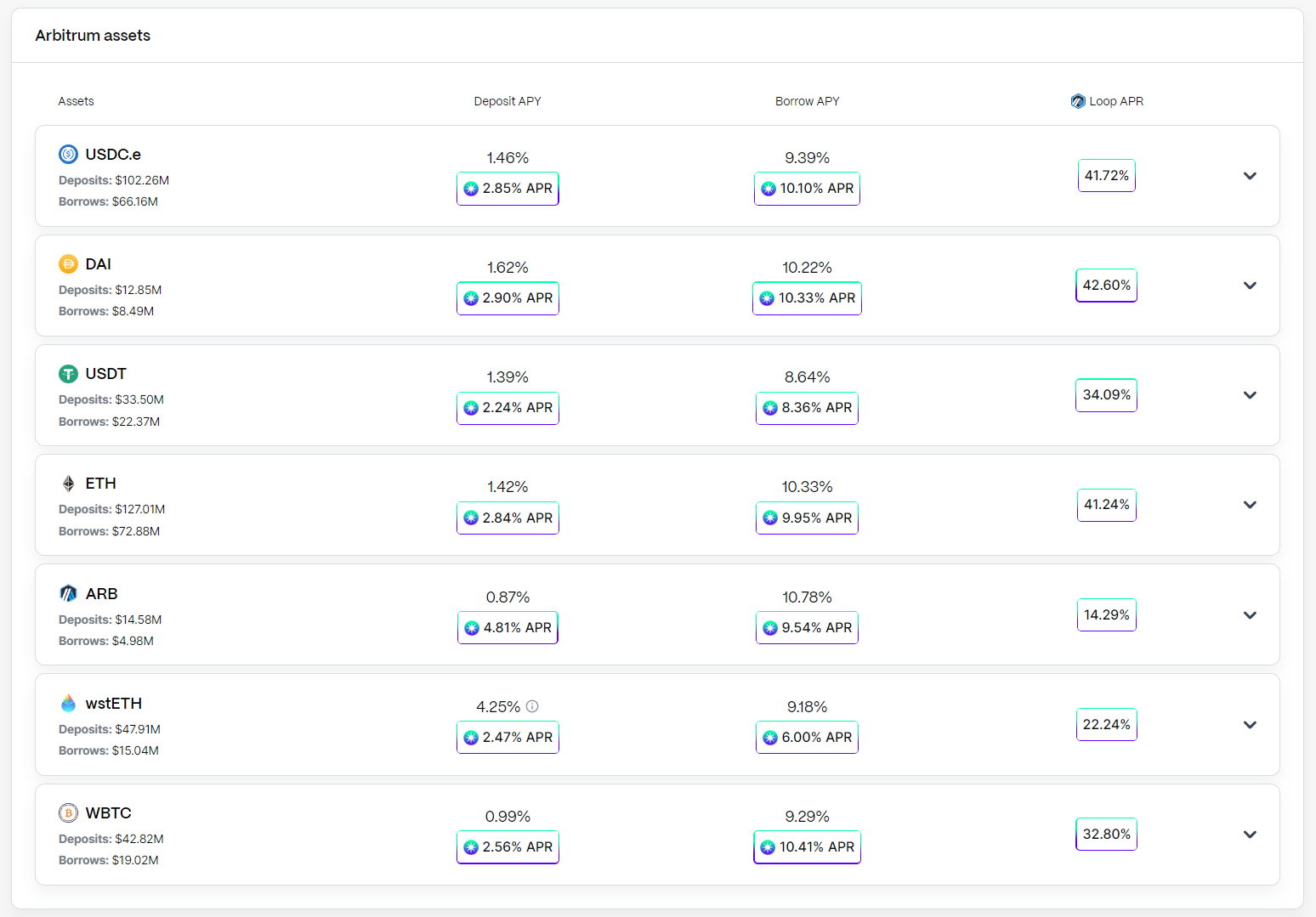

Radiant lending and borrowing on

Arbitrum.

Radiant is the largest lending platform

on Arbitrum with $172.79 million in TVL. Follow by Aave the second largest with

$157.74 million in TVL.

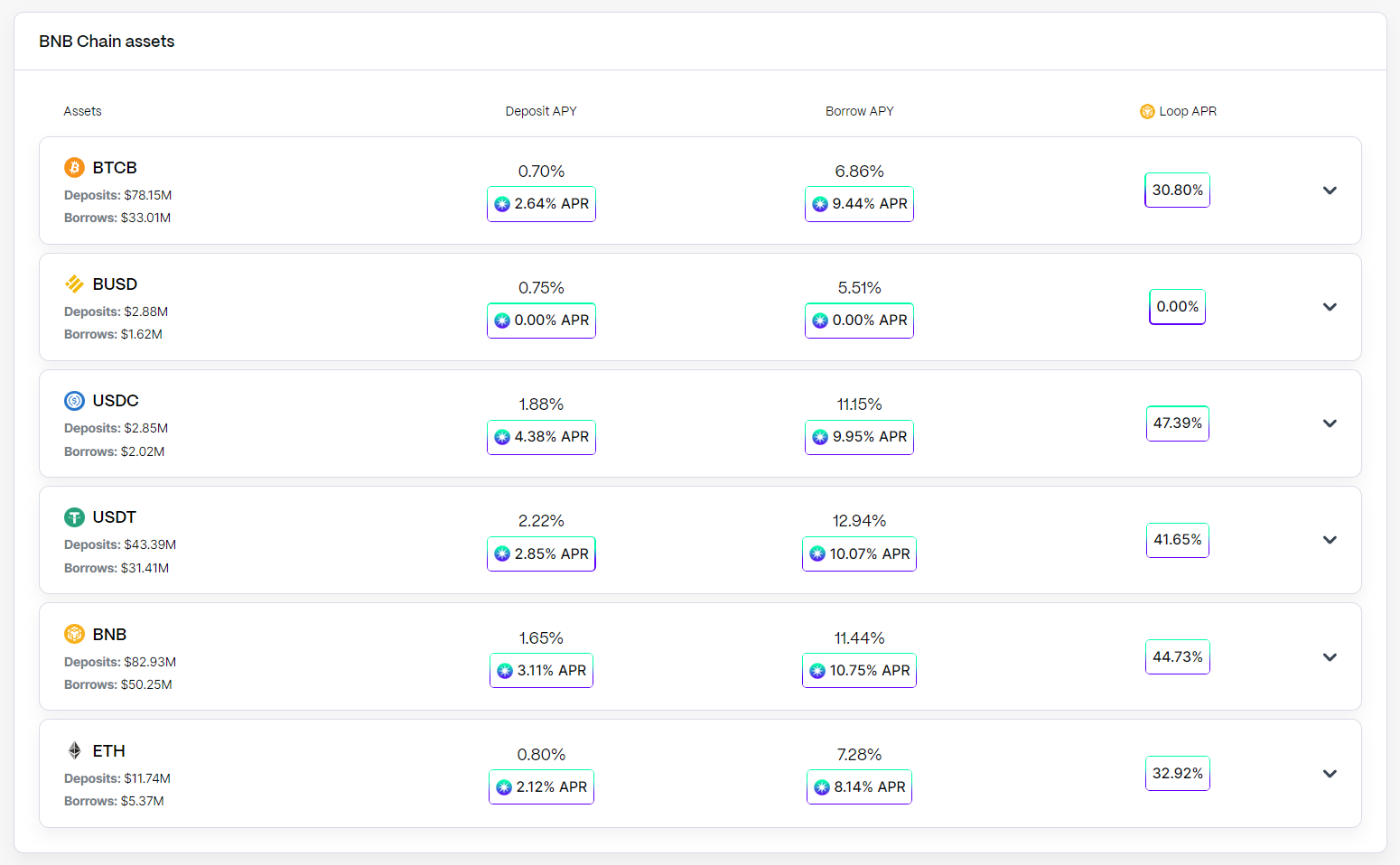

Radiant lending and borrowing on BNB

Chain.

Radiant Capital currently has $271.44

million TVL on both Arbitrum and BNB Chain.

Binance Labs, the investment arm of

Binance invested $10 million in Radiant Capital in July 2023. Binance Labs also

invested in LayerZero Labs.

Radiant Capital (RDNT)

Ranking: 284th

largest crypto by market cap.

Market cap: $74 million.

Fully diluted market cap: $227 million.

Circulating supply: 32.64%.

As of October 9, 2023.