2025-05-01

Robinhood outperformed Wall Street’s Q1

expectations even as it faced a notable decline in revenue and a sharp drop in

cryptocurrency trading activity.

The trading platform reported $927

million in revenue for the first quarter of 2025, an 8.6% drop from the

previous quarter, but still 3.16% above Zacks analyst estimates.

Year-over-year, revenue jumped 50%,

underlining the company’s longer-term growth trajectory.

Transaction-based revenues surged 77%

compared to Q1 2024, reaching $583 million.

This growth was driven by a 100%

year-over-year increase in crypto revenue to $252 million, a 56% rise in

options revenue to $240 million, and a 44% gain in equities revenue to $56

million.

Despite this year-over-year momentum,

Robinhood’s crypto trading volume fell 35% quarter-over-quarter, with revenues

from crypto down 30% compared to Q4 2024, when the company posted record

numbers.

The decline coincided with an 18% drop

in overall crypto market capitalization, partly blamed on tariffs introduced by

the Trump administration. Robinhood also reported a 10% decrease in customer

trades placed and a 27% drop in average trade size.

CEO Vladimir Tenev acknowledged the

volatility in crypto trading but emphasized that the company is focused on

expanding its market share.

He also reaffirmed the firm’s

commitment to innovation in digital assets, noting that tokenization of private

equities remains a strategic priority.

“Tokenizing private equities could

unlock massive opportunities,” Tenev said, envisioning a future where investors

can buy tokenized shares of companies like OpenAI or SpaceX in minutes.

Robinhood continued its shareholder

buyback program in Q1, adding $500 million to bring the total authorization to

$1.5 billion.

So far, it has repurchased $667 million

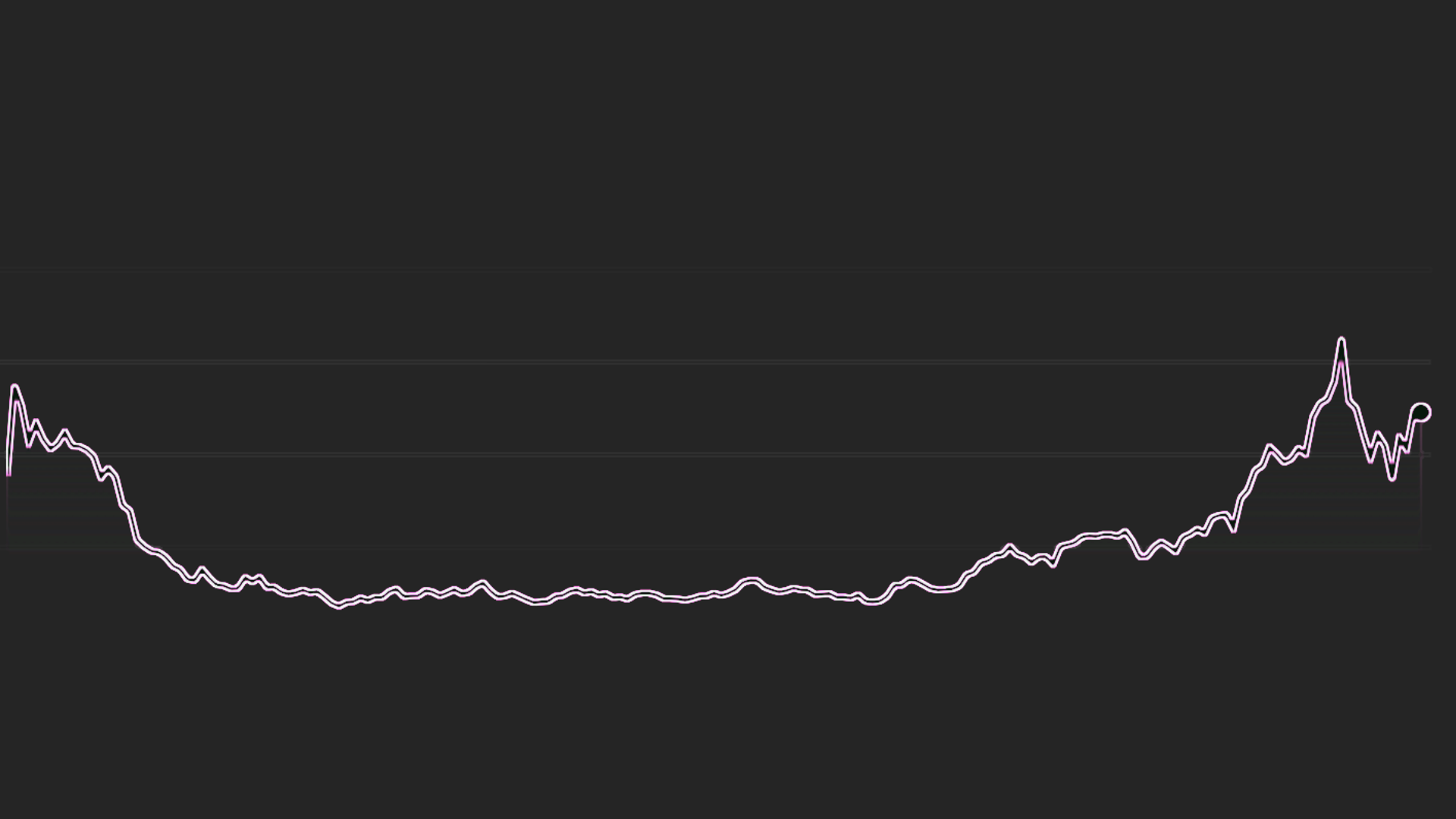

in shares. Following the earnings release, Robinhood’s stock (HOOD) rose 1.51%

in after-hours trading to $49.85, according to Google Finance.

The firm’s $200 million acquisition of

Bitstamp remains on track, with regulatory approval expected by mid-2025. This

move would position Robinhood to serve institutional crypto investors in the

U.S.

On the regulatory front, Robinhood got a boost in Q1 when the Securities and Exchange Commission closed its investigation into the company’s crypto operations on February 21.

Robinhood Stock