2023-05-18

Liquid staking governance tokens like LDO and RPL are the hottest

tokens right now.

Are there any other liquid staking tokens that the price can go up? Let’s explore.

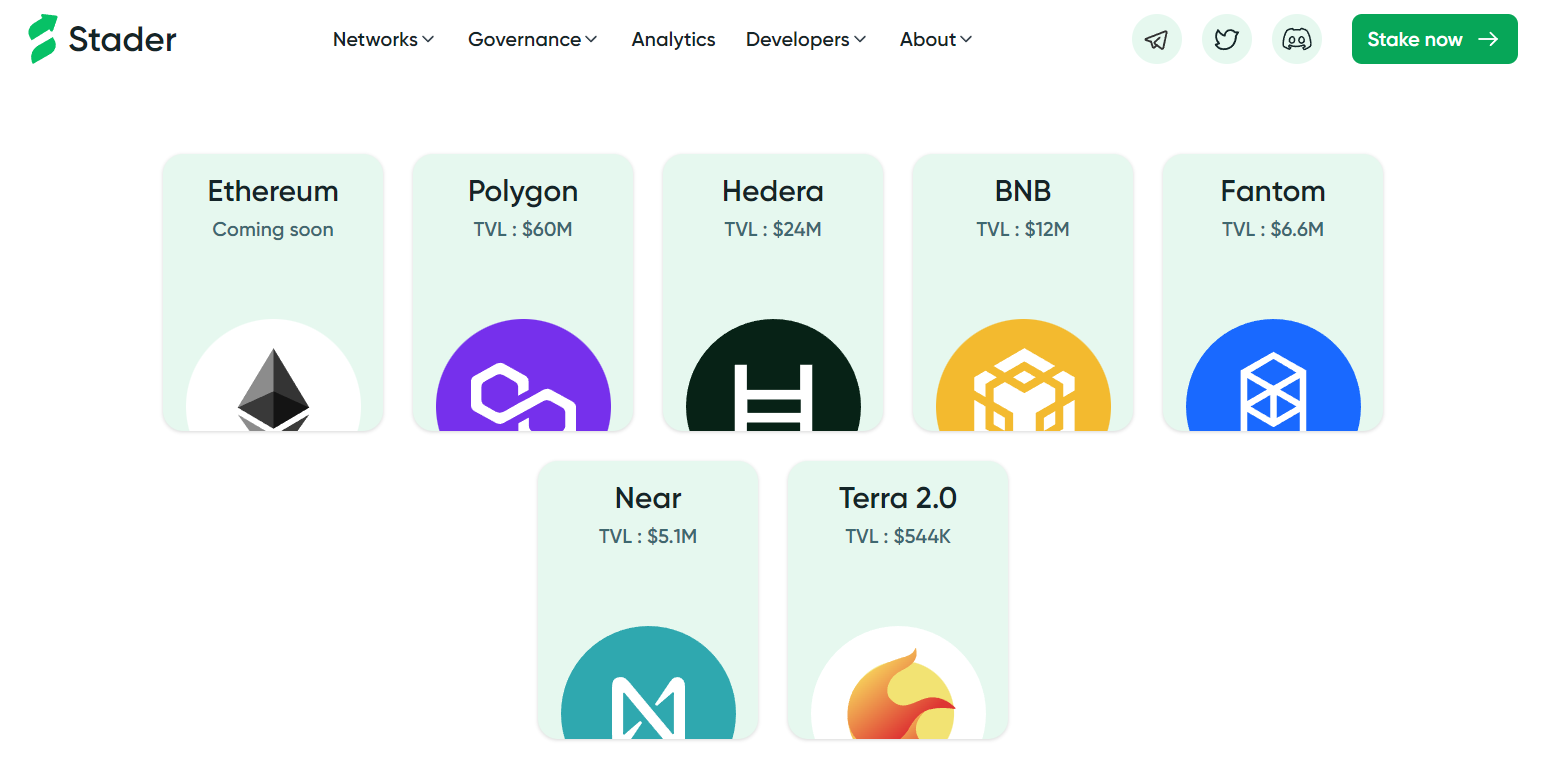

Stader is a liquid staking service provider. The platform allows users to stake 7 different coins include:

1. Ethereum

Available soon

2. Polygon

TVL: $106 million

APY: 4.74%

3. Hedera

TVL: $106 million

APY: 8.48%

4. BNB

TVL: $11 million

APY: 3.92%

5. Fantom

TVL: $107 million

APY: 4.7%

6. Near

TVL: $106 million

APY: 8.84%

7. Terra 2.0

TVL: 410,628 LUNA

APY: 15.4%

Stader has a governance token called “SD”. Token holders can vote on

proposal through Stader DAO.

SD tokens have a max supply of 150,000,000 SD, it has fully diluted

market cap of $140 million. 6.77% of SD tokens are circulating in the market.

Largest liquid governance tokens by fully diluted market

cap.

1. Lido DAO (LDO), fully diluted market cap $2.28 billion.

2. Rocket Pool (RPL), fully diluted market cap $973 million.

3. Frax Share (FXS), fully diluted market cap $730 million.

4. Ankr Network (ANKR), fully diluted market cap $265 million.

5. Stader (SD), fully diluted market cap $140 million

6. Bitfrost (BFC), fully diluted market cap $120 million.

SD Price Prediction

It depends on TVL. If TVL grows, SD

price will grow accordingly. However, Stader definitely has a chance to grow

because cryptocurrencies are moving toward staking.