2023-05-12

If you have cryptocurrencies such as

ETH, AVAX, MATIC, DAI, or USDT and you don’t have a plan to sell them. You can

lend your crypto in lending platforms to earn passive income.

One of them is Aave. It is a lending

and borrowing platform for cryptocurrencies. AAVE is a governance token of

Aave. Maximum supply of AAVE is 16 million

AAVE.

Uniswap is the winner in decentralized

exchange category. While, Aave emerges as the winner of lending and borrowing

platform. Aave is the most successful lending platform in term of both TVL and

market cap.

Aave supports 8 blockchains include:

1. Ethereum

2. Arbitrum

3. Avalanche

4. Fantom

5. Harmony

6. Optimism

7. Polygon

8. Metis

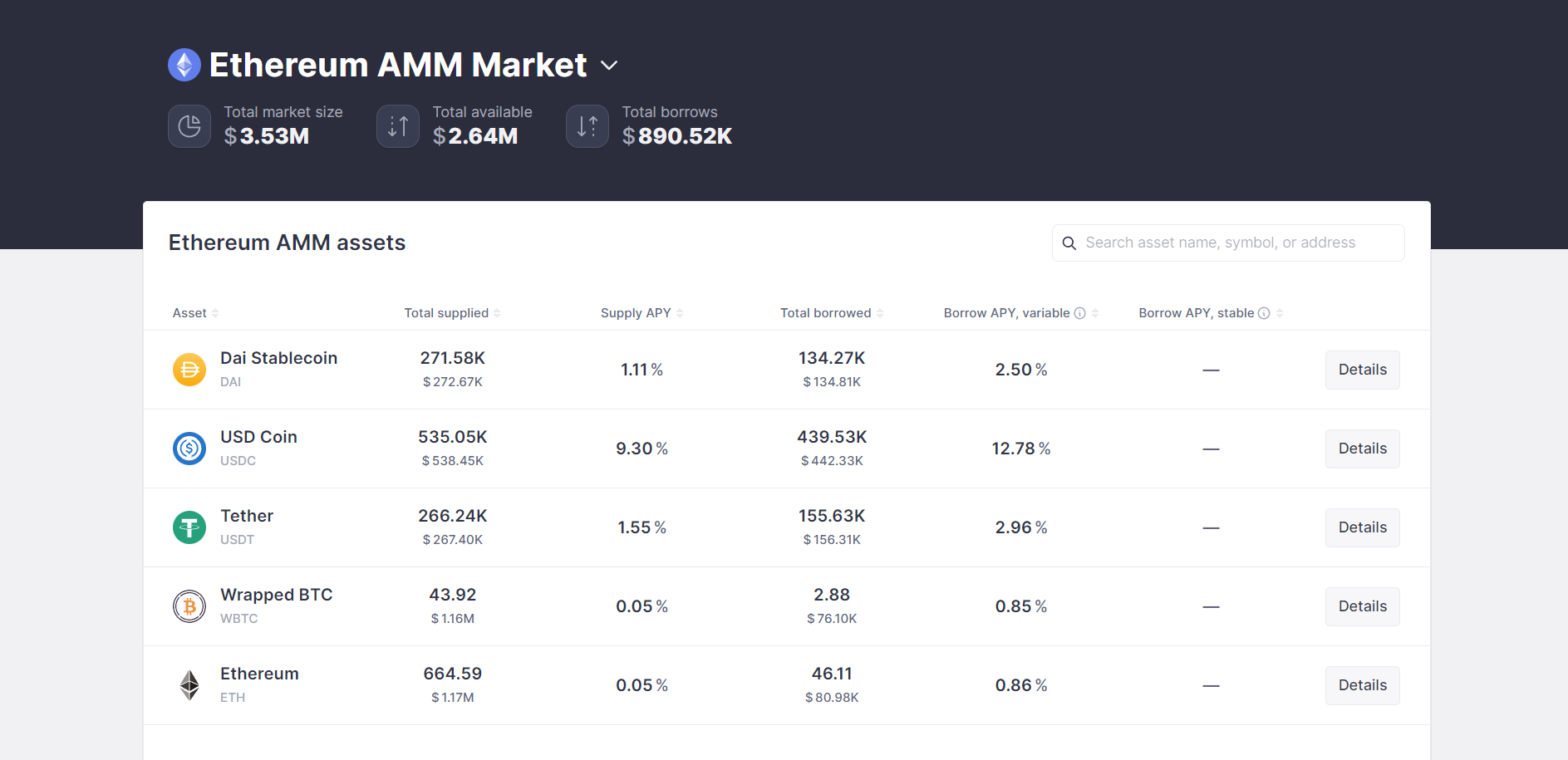

Aave supports more than 14 coins and

tokens for lending and borrowing.

1. DAI

2. USDC

3. USDT

4. AAVE

5. BAL

6. LDO

7. LINK

8. CRV

9. MKR

10. ETH

11. WBTC

12. AVAX

13. FTM

14. SUSHI

Flash Loans

One of the advantages of Aave is that

it launched the first uncollateralized loans besides normal lending. Flash

loans let you temporarily borrow crypto assets with zero collateral.

There are 3 popular crypto lending

platform. The first one is Aave. Follow by Compound. Compound is a lending

platform with COMP as a governance token. The third one is Venus. If you don’t

like ETH high gas fees. You can use Venus, it runs on BNB Chain.

TVL: $5.0 billion

Fully diluted market cap: $969 million.

AAVE ranks 49th largest

crypto by market cap.

TVL: $1.8 billion

Fully diluted market cap: $346 million.

COMP ranks 115th largest

crypto by market cap.

TVL: $ 782 million

Fully diluted market cap: $136 million

XVS ranks 310th largest crypto by market cap.

(As of May 12, 2023)

Aave and Compound as well as Venus have been competing with each other to attract users. The result has come, Aave is the winner.