2024-09-30

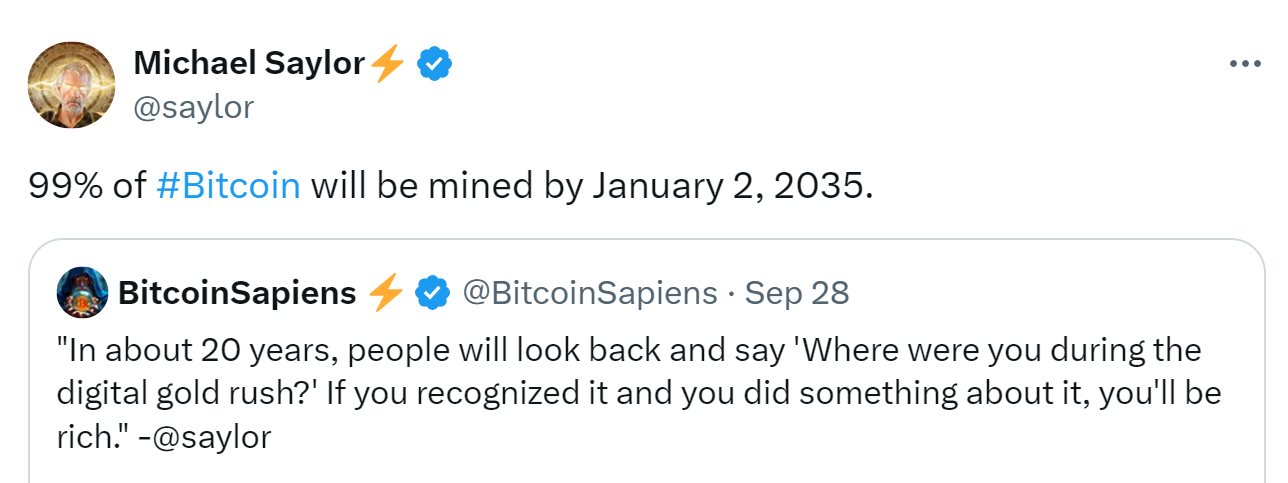

Michael Saylor⚡️ on X: "99% of #Bitcoin will be mined by January 2, 2035."

Michael Saylor, the co-founder and chairman of MicroStrategy,

on September 28, 2024, made a bold prediction that has captured the attention

of the crypto community. He stated that 99% of Bitcoin will be mined by January

2, 2035. This prediction suggests an acceleration in Bitcoin mining activities

over the next decade, which would see nearly 5% more of Bitcoin’s maximum

supply being mined.

Currently, about 94.10% of Bitcoin’s total supply has been

mined. If Saylor’s prediction holds true, it would mean that the remaining 1%

of Bitcoin will become increasingly scarce, potentially driving up its price as

demand outstrips supply. This could significantly impact the economics of

Bitcoin mining, with miners having to adjust to an environment where the

rewards for mining new blocks are significantly decreased.

What is Bitcoin halving?

Bitcoin halving events are an integral part of Bitcoin's

design, programmed to occur every four years (or every 210,000 blocks). The

purpose of halving is to reduce the rate at which new bitcoins are created,

ultimately capping the total supply of Bitcoin at 21 million.

Here's a summary of how the halving process works and the

timeline until the last bitcoin is mined.

Bitcoin Halving Overview

Initial Block Reward: When Bitcoin was launched in 2009, miners received 50 BTC

per block.

Halving Schedule: Every 210,000 blocks, or roughly every four years, the

block reward is halved.

Effect of Halving: The reduction in block rewards decreases the rate of new

bitcoin creation, making Bitcoin increasingly scarce over time.

Past and Future Halving Events

1. First Halving (2012)

o Date: November 28, 2012

o Block Reward Reduced from: 50 BTC to

25 BTC

o Total Supply Created by This Point: 10.5 million BTC

2. Second Halving (2016)

o Date: July 9, 2016

o Block Reward Reduced from: 25 BTC to

12.5 BTC

o Total Supply Created by This Point:

Approximately 15.75 million BTC

3. Third Halving (2020)

o Date: May 11, 2020

o Block Reward Reduced from: 12.5 BTC

to 6.25 BTC

o Total Supply Created by This Point:

Approximately 18.375 million BTC

4. Fourth Halving (2024)

§ Estimated Date: Around April 2024

§ Block Reward Reduced from: 6.25 BTC

to 3.125 BTC

§ Total Supply Created by This Point:

Approximately 19.6875 million BTC

5. Fifth Halving (2028)

§ Estimated Date: Around 2028

§ Block Reward Reduced from: 3.125 BTC

to 1.5625 BTC

6. Sixth Halving (2032)

§ Estimated Date: Around 2032

§ Block Reward Reduced from: 1.5625 BTC to 0.78125 BTC

7. Seven Halving (2036)

By the 7th halving, a significant portion of the total 21

million bitcoins will have already been mined. After the 7th halving,

approximately 99.999% of all bitcoins will have been mined. This means

that by 2036, the total supply will be 20.999 million BTC.

Further Halvings: The halving will continue approximately every four years,

progressively reducing the reward per block until it becomes negligible.

Last Bitcoin Mined: The Year 2140

Implications of Halving

1. Reduced Inflation: Each halving reduces the rate of

new supply, which can contribute to increased scarcity and potential value

appreciation, assuming demand remains constant or increases.

2. Miner Revenue: Miners' revenue from block rewards

diminishes, meaning they increasingly rely on transaction fees for

compensation, especially after the block rewards become very small.

3. Network Security: As halvings occur, miner incentives

change, potentially affecting the security of the Bitcoin network. After the

final bitcoin is mined, the system will rely entirely on transaction fees.

Conclusion

The Bitcoin halving process will continue roughly every four

years until around the year 2140, when the last bitcoin will be

mined, reaching the total supply limit of 21 million. After this, the

Bitcoin network will rely on transaction fees to incentivize miners, while the

total supply will remain fixed. This mechanism ensures a predictable and

decreasing supply of new bitcoins, which contributes to its scarcity and its

potential value as a deflationary digital asset.