2024-06-12

On June 11, 2024, Lido has introduced a new initiative

called “Restaking Vaults” in collaboration with Symbiotic, Drop, and Mellow

Finance.

This move is part of Lido’s strategy to maintain its

position within the Ethereum decentralized finance (DeFi) ecosystem,

particularly in response to the growing trend of restaking.

Lido is forming Lido Alliance members by partnering with

Mellow Finance , Drop, and Symbiotic to create the vaults (restaking vaults).

Drop is an innovative Cosmos LST that expands use-cases for

wstETH, helping decentralize Ethereum adoption.

stETH holders can navigate the Interchain with their

existing collateral and benefit from Drop’s secure architecture on Neutron and

other IBC chains.

While, Mellow is a novel modular infrastructure for

creating liquid restaking tokens.

This allows curators to launch a variety of vaults with

different risk exposures and curation choices.

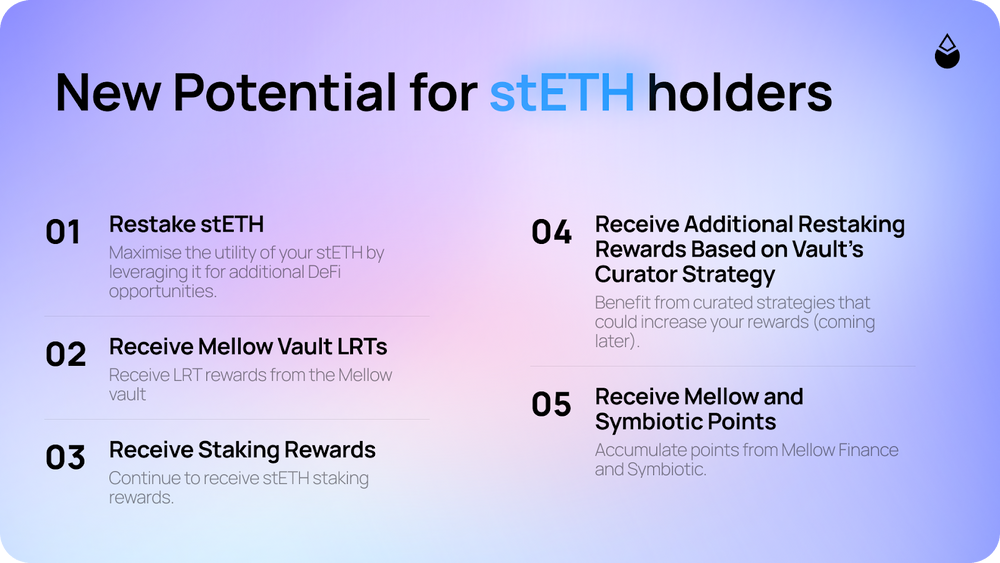

stETH users can enjoy unrestricted access to restaking

through Mellow, and can restake their collateral across a variety of curated

vaults.

The vaults are Lido's Ethereum restaking space to provide

Ethereum stakers with access to restaking opportunities.

Restaking boosts the utility and liquidity of staked ETH.

Users can deposit assets like Lido staked ETH (stETH) into these vaults.

1. Vaults are designed to allow stETH holders to participate

in decentralized restaking.

2. Restaking vaults for stETH.

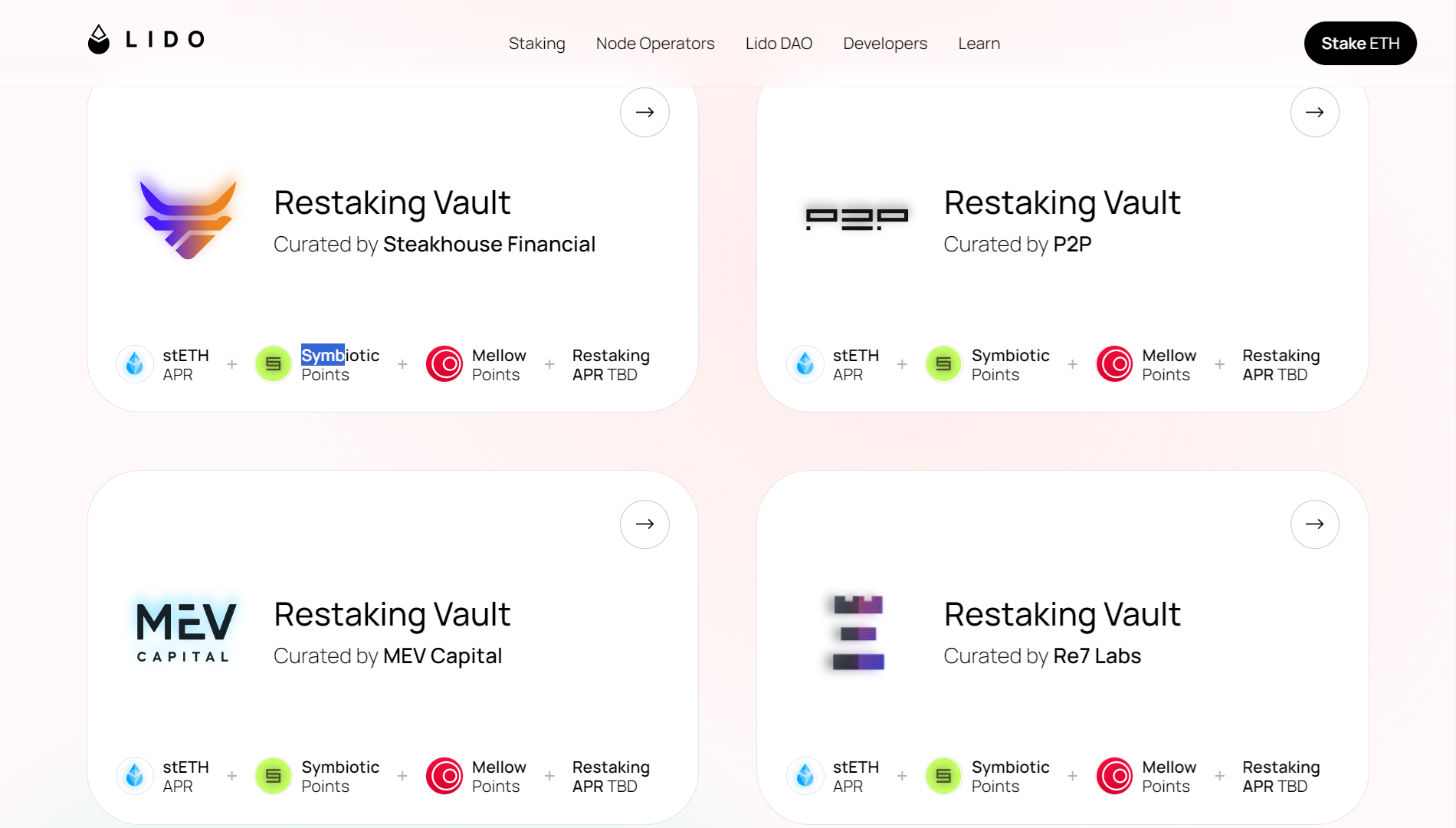

At launch, 4 vaults

will be available for stETH holders to experiment with DeFi restaking.

1. Rest(e)aking Vault -

Steakhouse Financial: stETH APR + Symbiotic Points

+ Mellow Points + Restaking APR

2. Restaking Vault - P2P

Validator: stETH APR + Symbiotic Points + Mellow Points + Restaking

APR

3. Restaking Vault - MEV

Capital: stETH APR + Symbiotic Points + Mellow Points + Restaking

APR

4. Restaking Vault - Re7 Labs: stETH APR + Symbiotic Points + Mellow Points + Restaking APR

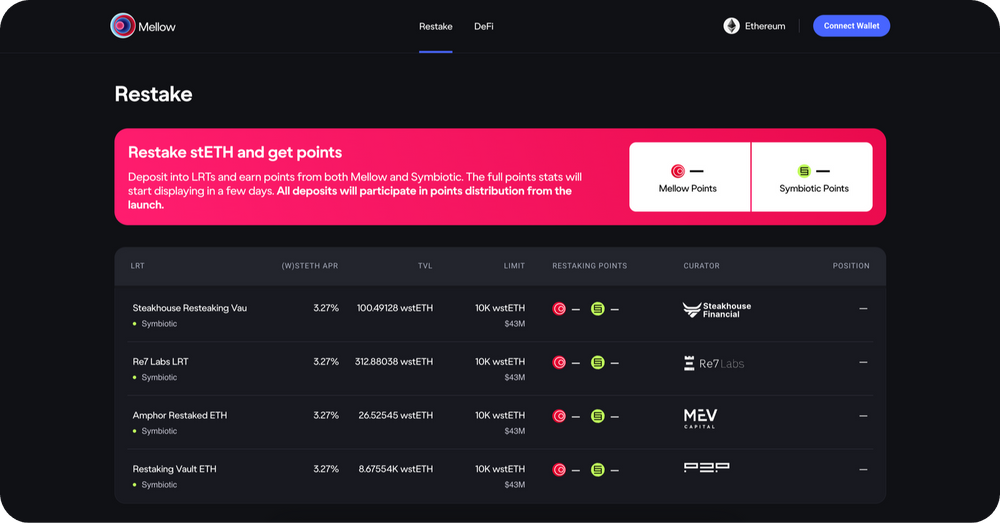

3. Restaking with Mellow Finance.

As of June 12, 2024, Lido is the largest DeFi protocol on

Ethereum with $33.513 billion in deposits and stETH is one of the most popular

assets in DeFi.

Lido’s dominance has been challenged by restaking services

like EigenLayer, which allow restaking of assets to secure other networks.

Lido Alliance members are committed to protecting stETH’s

role in Ethereum DeFi.

The launch of stETH-centric restaking products on Mellow

Finance is part of Lido’s strategy.

This development represents Lido’s effort to adapt to the evolving DeFi landscape and to offer Ethereum stakers more opportunities to generate yield through restaking.