2024-08-03

Lido Finance is a decentralized finance

(DeFi) protocol that provides liquid staking services for various

cryptocurrencies.

It allows users to stake their crypto

assets (such as Ethereum, Solana, and others) in a manner that enables them to

earn staking rewards while still maintaining liquidity over their assets in the

form of liquid staking token.

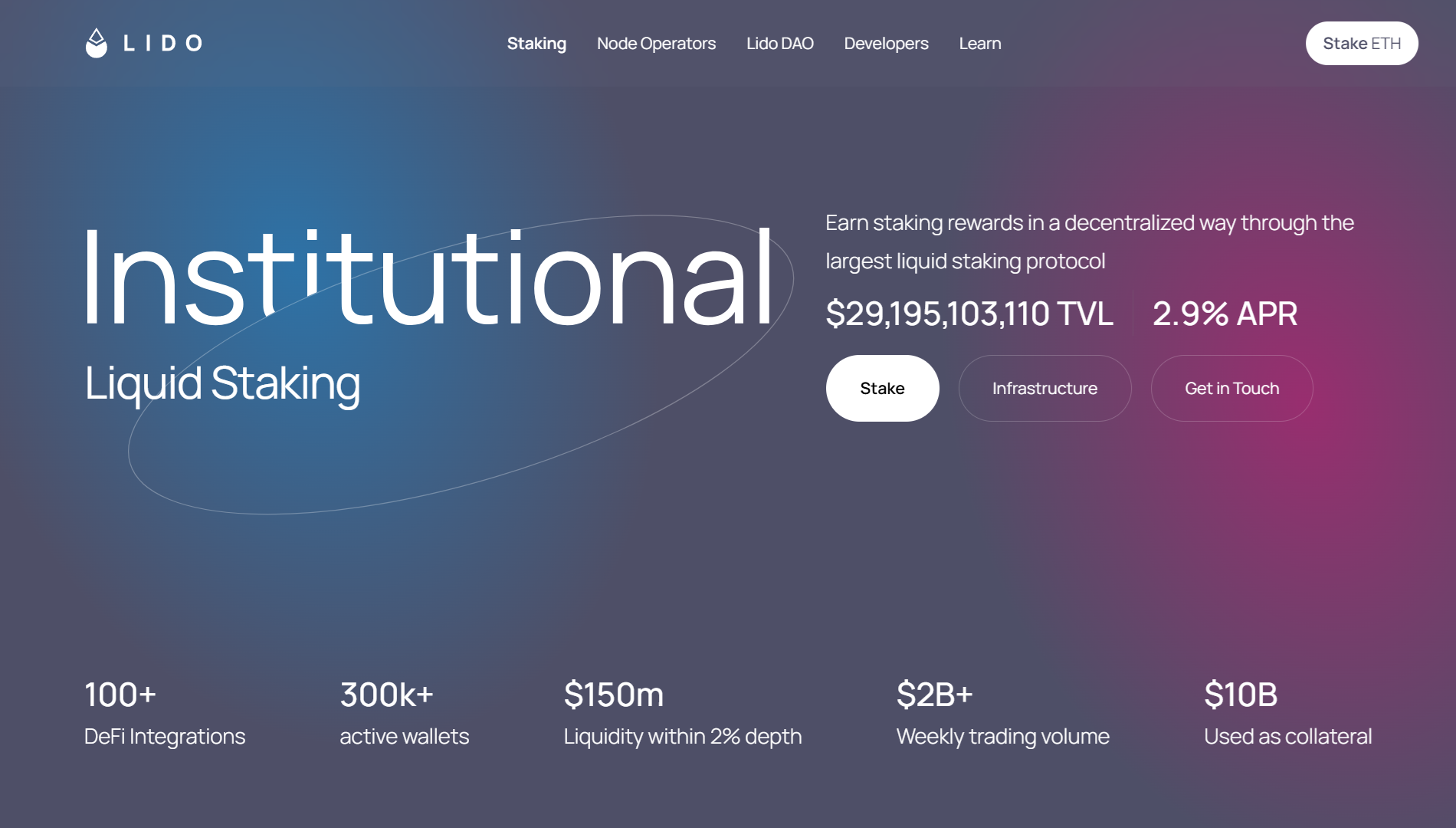

On August 2, 2024, Lido Finance announced that it has introduced Lido

Institutional, a liquidity staking solution tailored for large clients such as

custodians, asset managers, and exchanges.

Lido Institutional Liquid Staking

This institutional-grade service aims

to combine the necessary security and reliability for enterprise staking with

the liquidity and utility required for various institutional strategies.

Lido Institutional Liquid Staking

designed to earn staking rewards in a decentralized manner through the largest

liquid staking protocol.

Lido Institutional boasts over $30

billion in total value locked (TVL) and offers a competitive annual percentage

rate (APR) of 2.9%.

The platform provides deep organic

liquidity suitable for institutional demand and has a diversified counterparty

exposure with over 100 professional node operators.

Lido’s stETH token is Ethereum’s

leading liquid staking token, offering best-in-class security, deepest

liquidity, and competitive rewards.

More than $2 billion in rewards have

been paid since 2020, and the protocol is protected with over $4 million

invested in security measures, including audits and bug bounties.

Lido Institutional also addresses

regulatory compliance questions, ensuring that participating banks can remain

compliant with international and local AML and KYC regulations.