2024-12-03

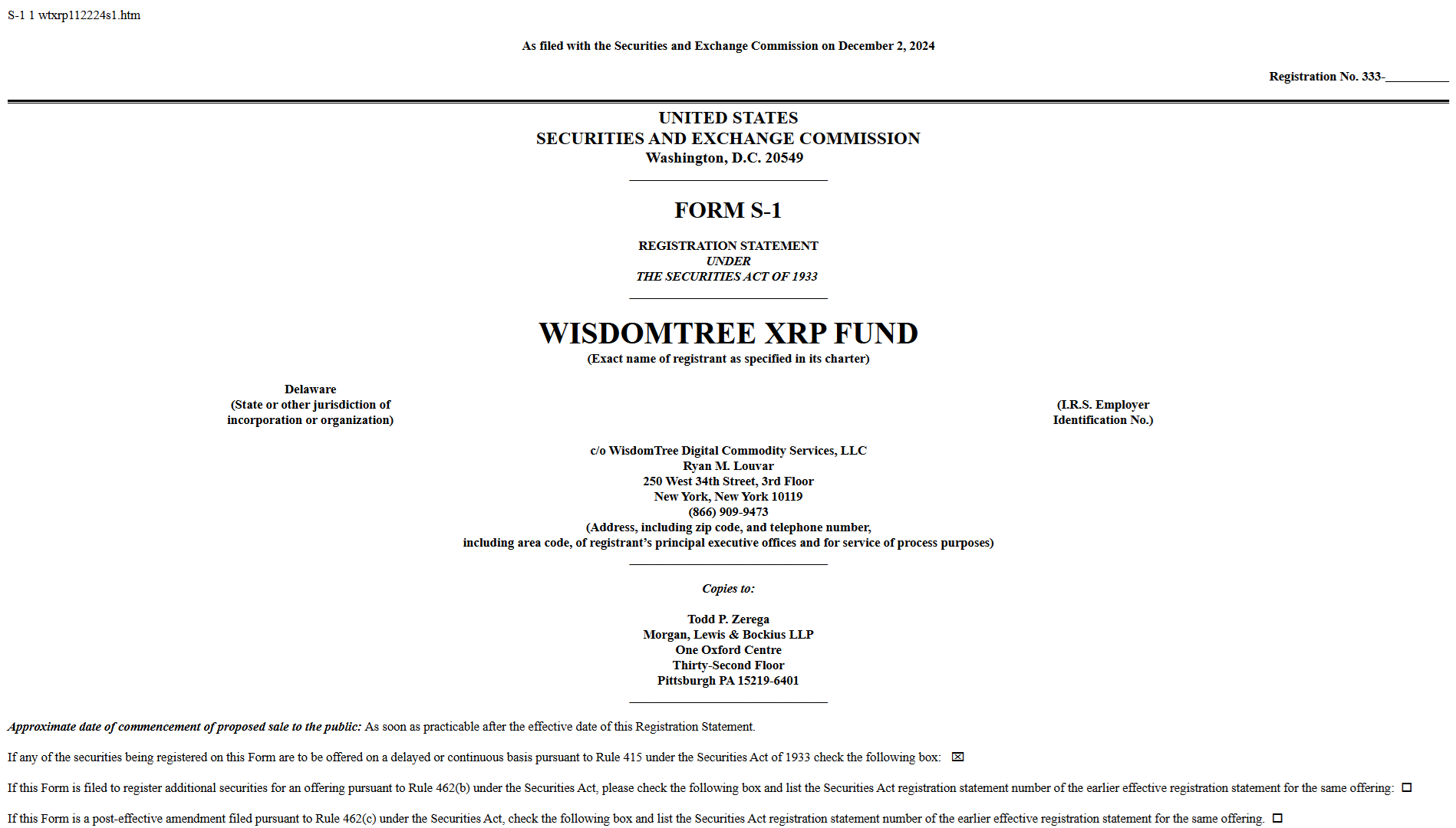

WisdomTree has filed a Form S-1 registration statement with the U.S.

Securities and Exchange Commission (SEC) for a spot XRP ETF on December 2,

2024.

sec.gov/Archives/edgar/data/2046791/000121465924019800/wtxrp112224s1.htm

This ETF aims to provide investors with exposure to the price of

XRP, the third-largest cryptocurrency by market capitalization. The Bank of New

York Mellon is proposed to serve as the trust administrator for the fund.

WisdomTree became the fourth firm in the U.S. to submit a Form S-1

filing with the SEC for a spot XRP ETF in the U.S. Other firms including

Bitwise, 21Shares, and Canary Capital, have also filed for XRP ETFs earlier

this year.

Bitwise filed its application on October 2, while Canary Capital

followed on October 9. 21Shares, co-issuer with ARK Invest for Bitcoin ETFs,

submitted its filing for Core XRP Trust on November 1.

The WisdomTree XRP Fund aims to provide investors exposure to XRP's

price movements. The shares are planned for listing on the Cboe BZX Exchange,

contingent upon SEC approval.

Coinbase Global will act as both the XRP custodian and the fund's

prime execution agent.

WisdomTree already leverages Coinbase for its Bitcoin ETF, which has

been trading since January 11, 2023.

This filing comes at a time of growing interest in XRP and its

regulatory clarity post-SEC litigation. The XRP spot ETF filings reflect the

industry's ambition to expand beyond Bitcoin-focused products, diversifying

investor opportunities in the cryptocurrency ETF market.