2025-01-04

January 1, 2025 – Ripple has

initiated its first major token sale of 2025, reserving 300 million XRP from

the 1 billion tokens unlocked at the start of the year.

This move aligns with the company's ongoing practice of monthly XRP sales, originating from its initial distribution strategy, which allocated 80% of XRP’s total supply to Ripple.

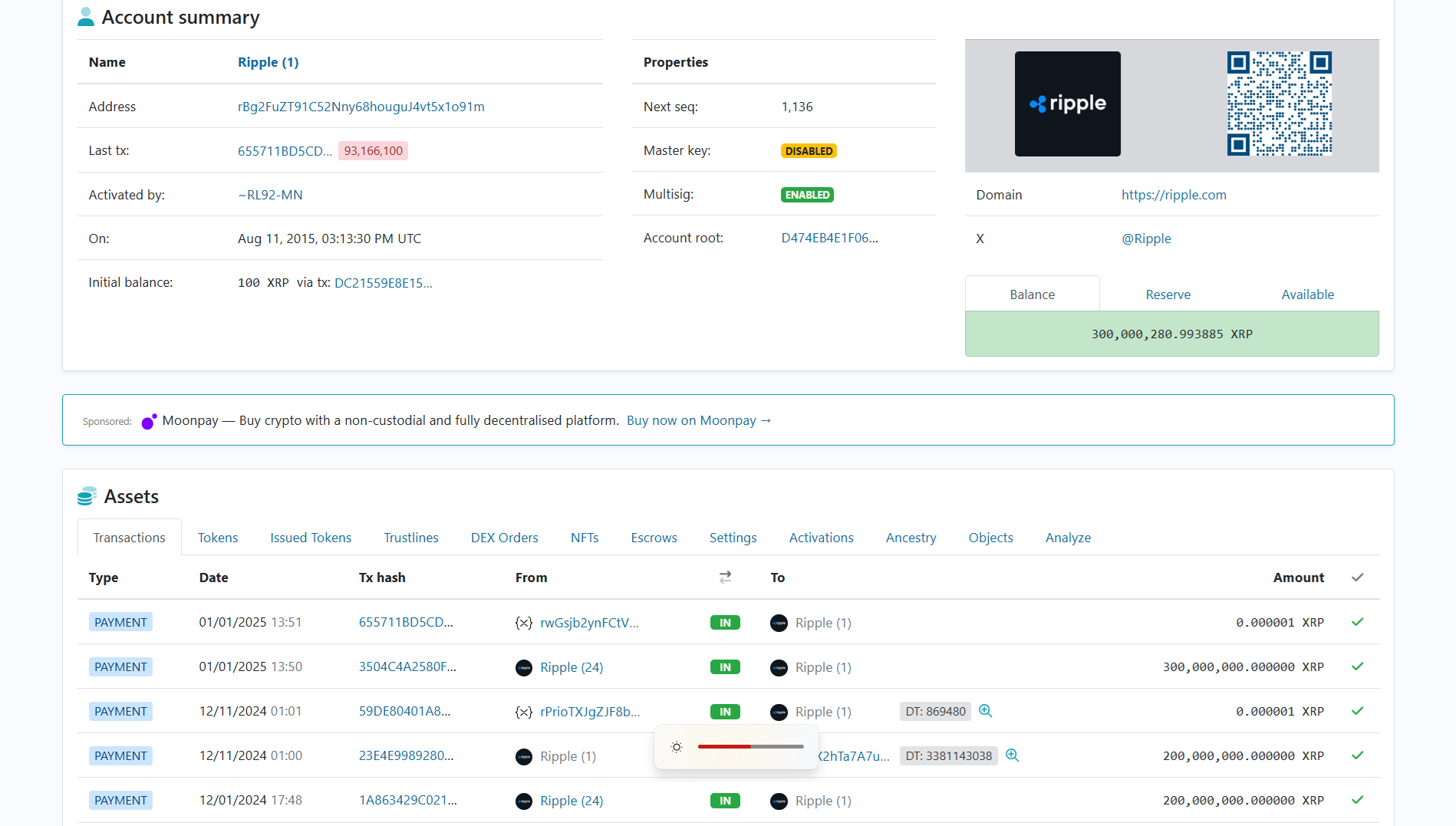

https://xrpscan.com/account/rBg2FuZT91C52Nny68houguJ4vt5x1o91m

According to blockchain data from XRP

Scan, Ripple transferred the 300 million XRP to its ‘Ripple (1)’ account from

the ‘Ripple (24)’ escrow account, which unlocked 500 million XRP for January.

The remaining 200 million unlocked

tokens were re-locked into a new escrow under the ‘Ripple (12)’ account,

continuing Ripple’s established pattern of token management.

Escrows and Future Token Unlocks

In addition to the ‘Ripple (24)’

activity, another 500 million XRP from the ‘Ripple (25)’ escrow account reached

its final unlock and was similarly re-locked into a new escrow under the

‘Ripple (13)’ account.

These remaining 700 million XRP from

the January escrows are now scheduled to reach finality by March 2028.

The January unlock marks the final

activity for escrows from the ‘Ripple (24)’ and ‘Ripple (25)’ accounts,

signaling a new phase in Ripple’s token management cycle.

2024: A Year of Major XRP Dumps

Ripple’s token sales in 2024 accounted

for 3.22 billion XRP through its ‘Ripple (1)’ account alone, with reports

suggesting additional sales from alternative accounts.

At an average trading price of $0.50

during 2024, the nominal value of these sales totaled approximately $7.5

billion, despite XRP currently trading at $2.33.

These sales represent a significant

impact on the crypto market, with Ripple’s yearly XRP sales vastly exceeding

industry standards.

By comparison, the Ethereum

Foundation’s annual sales of $100 million worth of ETH cause market ripples

despite Ethereum’s threefold larger market capitalization. Ripple’s XRP sales

budget, however, is 75 times higher.

Market Implications

Ripple’s sales operate through its

On-Demand Liquidity (ODL) model, which matches market prices and relies on

customer demand.

However, such large-scale token sales

raise concerns for XRP investors, as they can dilute the circulating supply and

pressure market demand to absorb the increased volume.

XRP holders are advised to monitor

Ripple’s escrow activities closely, as each unlock inflates the circulating

supply, impacting token value unless matched by proportional demand increases.

With 2025 off to a strong start for

Ripple’s token sales, the crypto community will be watching closely to gauge

the broader market impact of this year’s XRP dumps.