2023-06-01

Dai is a stablecoin that runs on the

Ethereum blockchain and aims to maintain a 1:1 peg with the U.S. dollar. Unlike

other stablecoins that are backed by fiat currency or gold, Dai is backed by a

mix of cryptocurrencies and other assets that are locked in smart contracts

called vaults.

Users can generate Dai by depositing

collateral into these vaults and paying a stability fee. Dai is governed by the

Maker Protocol and the MakerDAO community, which use the MKR token to vote on

various parameters and upgrades. It can be used for lending, borrowing,

trading, and saving in a decentralized way.

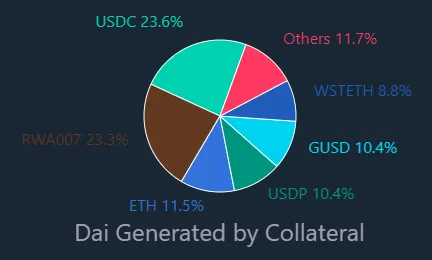

MakerDAO planned to reduce USDC exposure

and increased U.S. treasury bills backing DAI stablecoin. In August 2022, 50% of

DAI’s asset backed by USDC. Now, USDC backing DAI is only account for 23.6%.

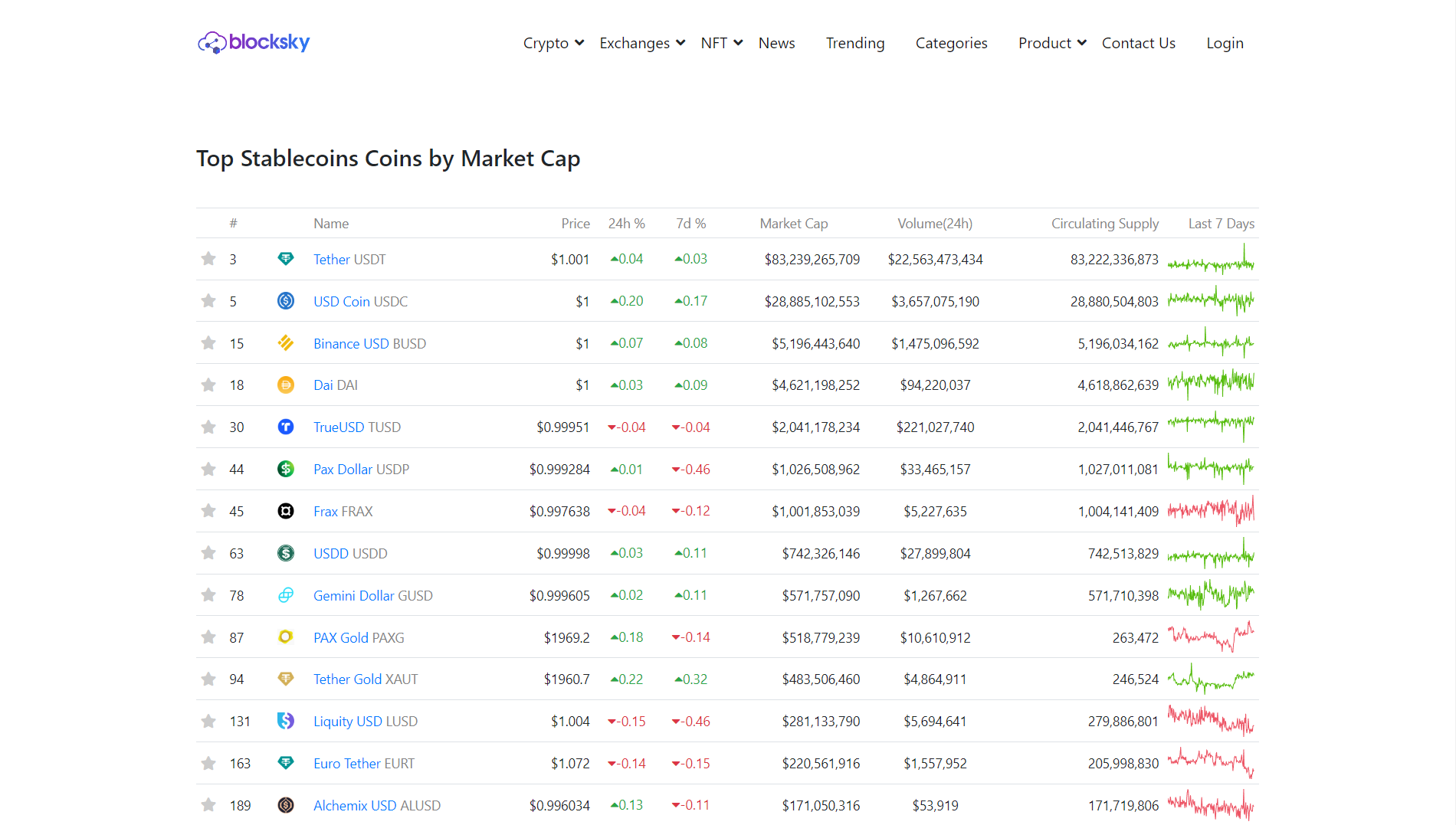

blocksky.io/categories/stablecoins