2023-05-18

The Lido

liquid staking protocol, which functions as a liquid staking derivatives (LSD)

protocol, has garnered attention as a popular option for ETH holders. It allows

users to stake their ETH with participating validators and earn additional ETH

as rewards. In return for staking their ETH, users receive stETH tokens, which represent

their staked ETH and accumulate additional rewards over time.

However,

until the recent upgrade to Lido version two, users were unable to withdraw

their staked ETH. The Shapella upgrade, implemented on April 13, introduced the

functionality for validators to withdraw their Ether held in the staking

contract. Nonetheless, Lido's software did not initially integrate this

withdrawal feature.

On May 15, the Lido decentralized autonomous organization (DAO) held a vote and decided to upgrade Lido to version two, enabling withdrawals for the first time. This development allowed stakers to realize that they could now withdraw their stETH tokens for their underlying Ether.

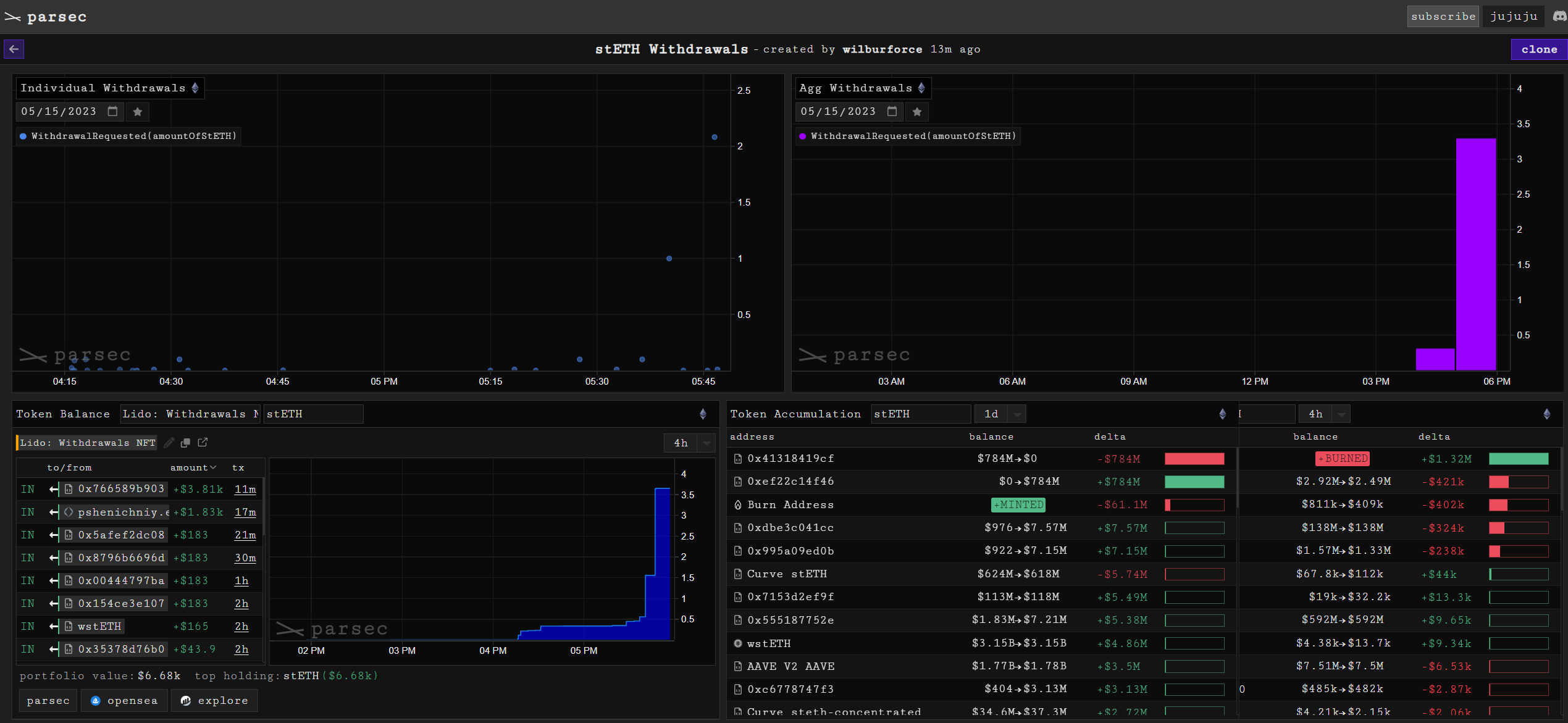

Data from Parsec Finance reveals that within the first three hours of the withdrawal feature being activated, over 260 Lido Staked Ether (stETH) tokens were redeemed, amounting to more than $500,000 worth of ETH. The pace of redemptions varied during this period, with approximately 4 ETH redeemed in the first hour, followed by a substantial increase to about 227 ETH in the second hour, and finally a decrease to around 44 ETH in the third hour.

Liquid

staking solutions, including Lido, have been gaining popularity in the

decentralized finance (DeFi) space. In fact, liquid staking became the top DeFi

category in terms of total value locked, surpassing decentralized exchanges,

according to DefiLlama on May 1. However, it is worth noting that there are

still legal considerations surrounding liquid staking in the United States, as

the Securities and Exchange Commission (SEC) has recently indicated that

staking providers may be viewed as securities issuers.

Overall, the introduction of withdrawals in Lido version two has attracted significant attention and activity, allowing users to reclaim the value of their staked ETH. It demonstrates the growing interest in liquid staking solutions and the potential they hold within the broader DeFi ecosystem.