2022-11-24

The Curve Finance’s developers have been released the official code and whitepaper for its stablecoin as decentralized exchange Curve Finance which will launch soon called crvUSD.

According to a report written by Curve Finance founder Michael Egorov, crvUSD will work similarly to MakerDAO's stablecoin called DAI. It relates to the project’s official GitHub exposed to show all projects are completed on its crypto-backed stablecoin.

The whitepaper describes that users are able to create stablecoins by depositing excess collateral in the form of cryptocurrency loans as reserves, a mechanism known as collateralized debt position (CDP).

Moreover, the Stablecoins also rely on a new algorithm called Lending-Liquidating AMM (LLAMMA), which will work continuously to liquidate and sell deposited collateral to better manage potential collateral risks.

Michael Egorov, the founder of Curve Finance, said stablecoins will complement Curve DAO token (CRV), Curve's native token, which is issued as a reward to those providing liquidity services in Curve Finance.

ref.

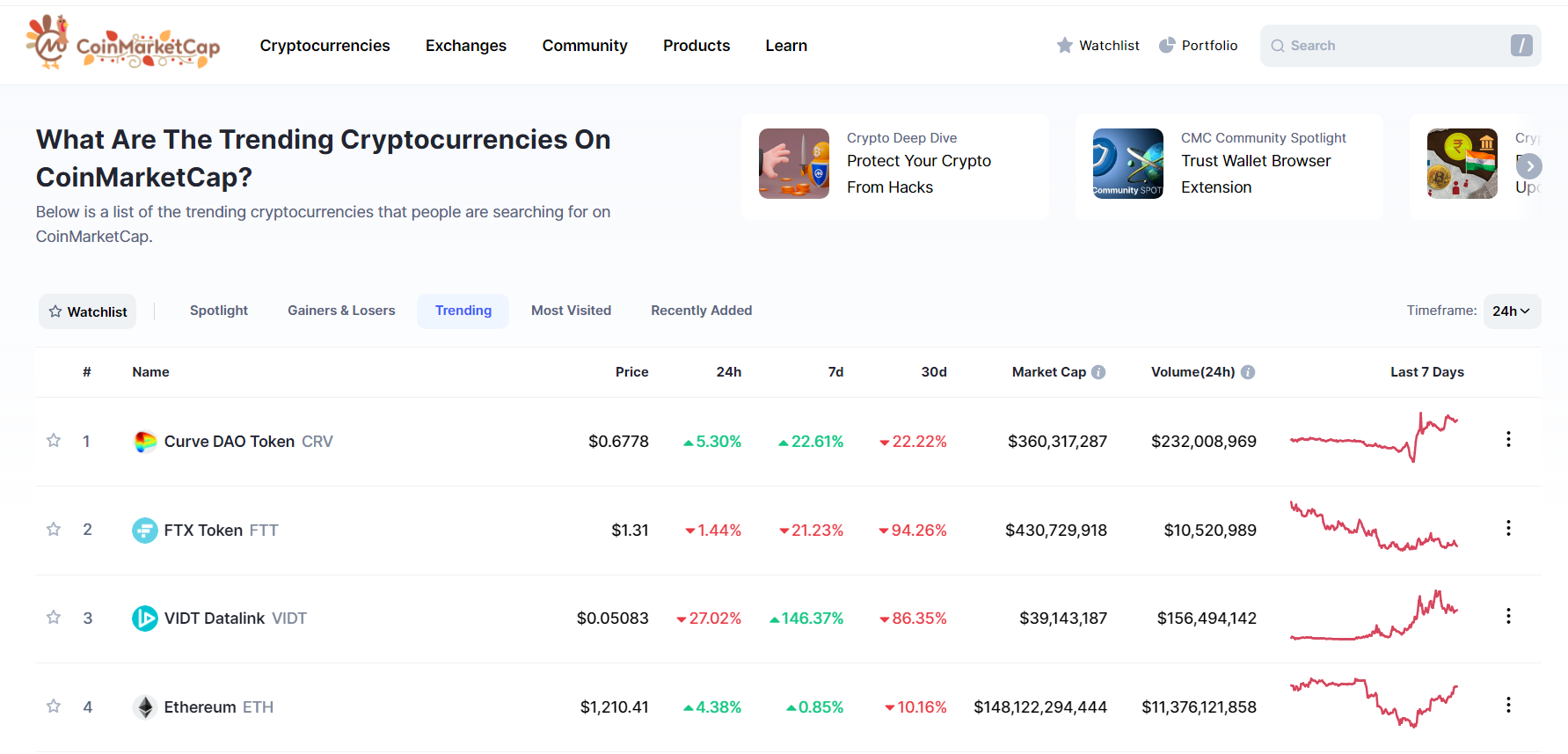

Reference the Curve DAO token's price is soaring up 4.62% in the last 24 hours and It's on the first list of the trending cryptocurrencies that people are searching for on CoinMarketCap.

ref. CoinMarketCap

Source link: The Block