2023-05-05

Curve Finance is a

decentralized finance (DeFi) protocol built on the Ethereum blockchain that

focuses on providing efficient and low-slippage trading of stablecoins and

other similar assets.

The developers of Curve Finance have used smart contracts to build the crvUSD stablecoin, which is a decentralized stablecoin. It has been launched on the Ethereum Mainnet. Meanwhile, the developers are currently working on improving the user interface (UI) for crvUSD.

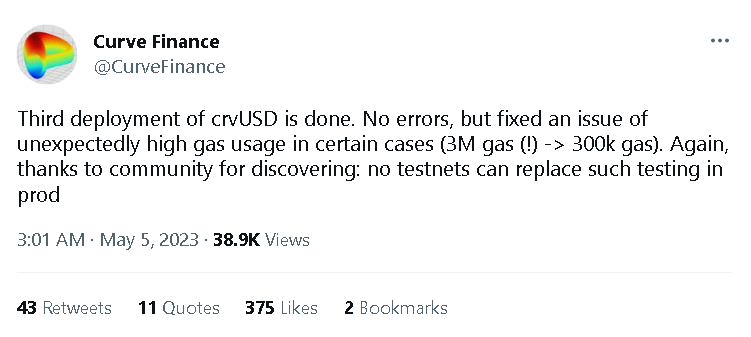

Curve Finance's

Twitter account recently revealed that there have been multiple Smart Contracts

created for the crvUSD stablecoin, but it has not been fully deployed yet

because the UI is still being developed. The team has created a circulating

supply of over 20 million crvUSD coins, which can be seen on Etherscan.

The crvUSD

stablecoin is a decentralized asset that is pegged to the value of the US

dollar, similar to MakerDAO's DAI stablecoin, but Curve Finance's crvUSD is

backed by a reserve of US dollars. crvUSD has a greater amount of

cryptocurrency backing than its circulating supply, and users can mint crvUSD

by borrowing money.

The crvUSD

stablecoin uses an algorithm called "Lending-Liquidating AMM (LLAMMA)"

which automatically liquidates and deposits collateral assets to manage

potential risks while maintaining its value to be equal to the US dollar.

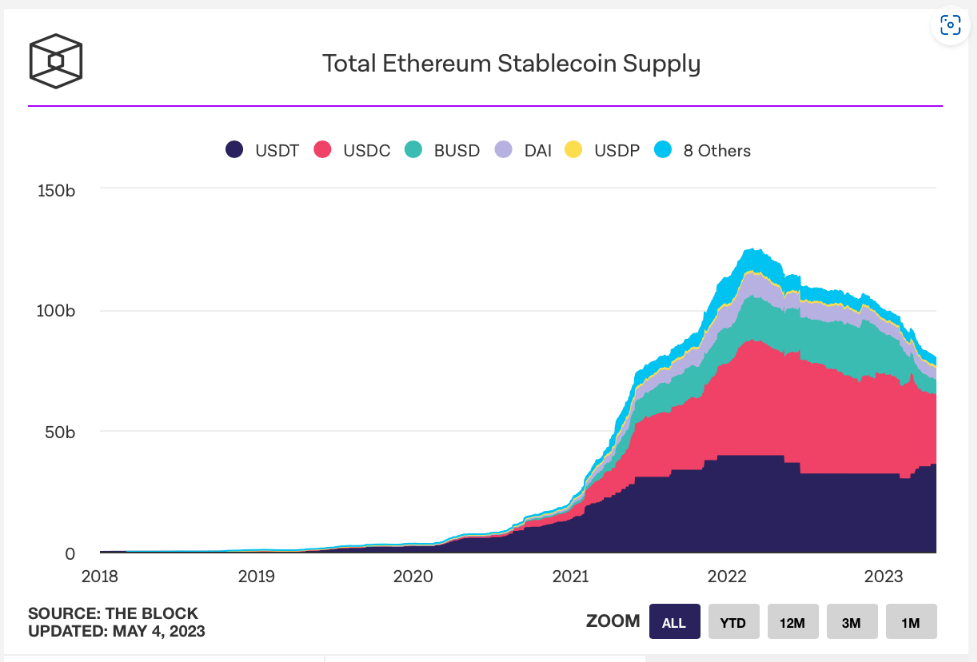

crvUSD is a stablecoin created by a well-known financial platform in the crypto industry, which competes with other stablecoins such as DAI. Currently, DAI has a market capitalization of $4.6 billion, and the lending platform Aave is testing the GHO stablecoin on the Goerli testnet since February.