2023-03-20

Many

crypto firms in America are exploring the option of moving their funds to

offshore banks.

Yves Longchamp, managing director of SEBA Bank, told Reuters by email: The bank experienced a significant increase in traffic from the United States, according to a report released Monday by representatives from its offices in Singapore, Hong Kong, Abu Dhabi, and Switzerland. It has been noticed that American customers are paying more attention.

“Crypto

firms and other money managers have already started the onboarding process and

many calls are scheduled next weeks,” wrote Longchamp.

At the same time, Arab Bank has seen an increase in interest from its crypto venture capital business since early March, when doubts about Silvergate's finances began to spread.

Rani Jabban, head of treasury at Arab Bank, said 80% of its customers, up from former Silvergate customers, however, regulatory issues regarding customer hospitality in the U.S. have led banks to limit customer exposure from about one or two companies in the end.

Banks such as Silvergate used to be hubs for U.S. crypto businesses, including the closed Coinbase, Bitstamp, CryptoCom and FTX.

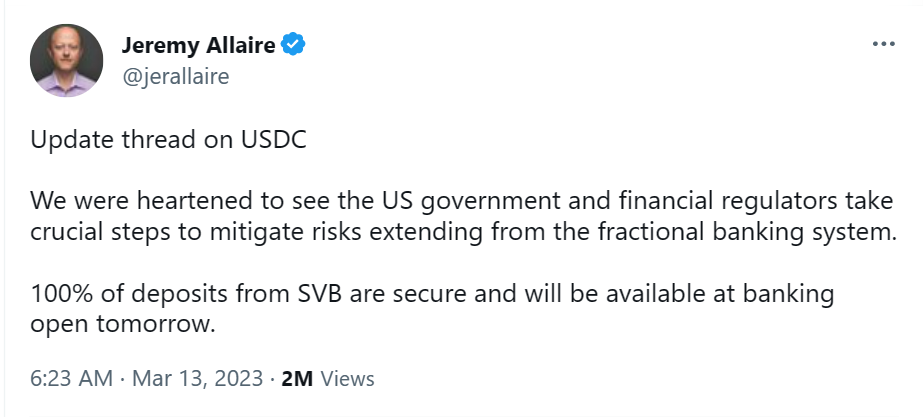

A part of Circle report that the bank has some USDC reserves in SVB, and Circle has transferred all its assets to the Bank of New York Melon.

Ref: Jeremy Allaire on Twitter

Finally, the moving fund to an offshore bank is a complex one that requires careful consideration both all benefits and risks that will be happens after decision.

Photo Credit: Link