2023-01-16

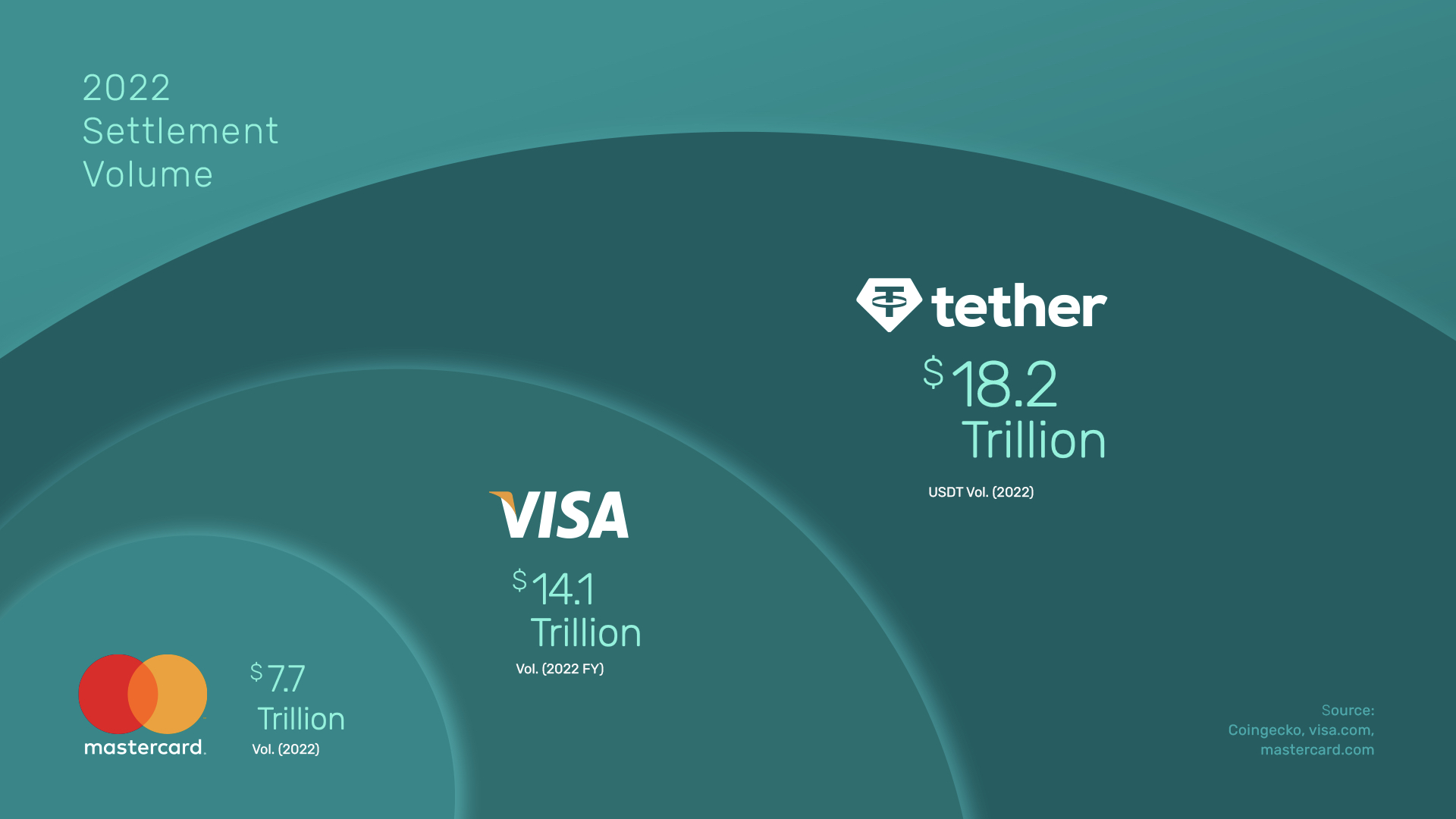

Tether USDT processed $18.2 trillion in 2022. More than Visa $14.1

trillion and Mastercard $7.7 trillion. USDT massive increase in transaction

volume comes from rapid growth over the use of stablecoins in the past several

years.

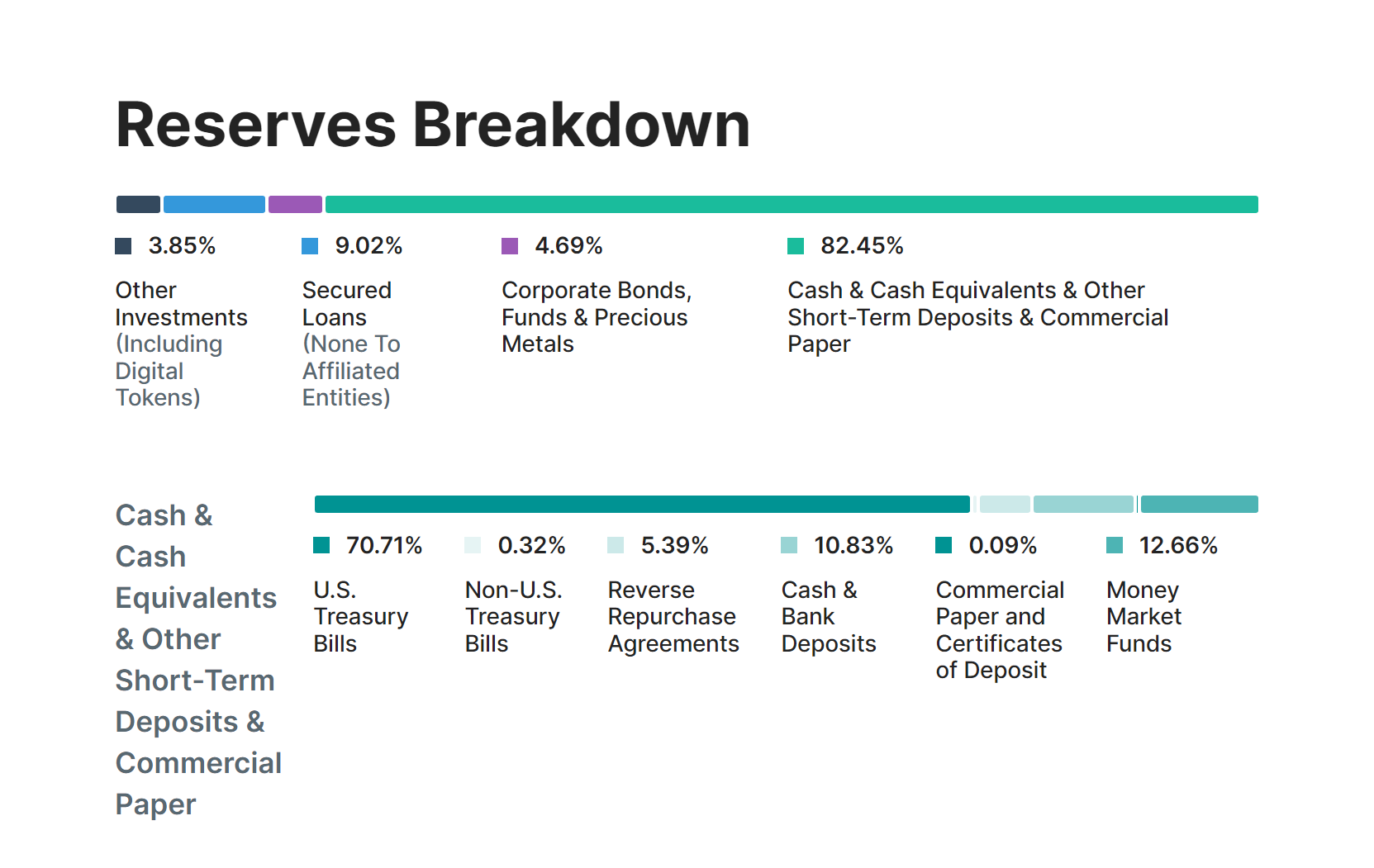

However, USDT lost its pegged to 1:1 US dollar ratio for many times.

USDT were able to recovered to 1:1 ratio after it lost 1 US dollar pegged. If a

lot of people rush to withdraw USDT to USD, Tether cannot immediately pay USD

to users because Tether has both USD and other non-liquid assets as underlying

assets. U.S. treasury bills are not liquid asset that can turn into USD

immediately.

Tether Underlying Assets (Update September 30, 2022)

U.S. Treasury Bills 70.71%

Money Market Funds 12.66%

Cash and Bank Deposits 10.83%

Reverse Repurchase Agreements 5.39%

Non-U.S. Treasury Bills 0.32%

Commercial Paper and Certificate of Deposit 0.09%

Secured Loans 9.02%

Corporate bonds, Funds, and Precious Metals 4.69%

Other Investments (Including Digital Tokens) 3.85%

Users benefit more in case stablecoins’ underlying asset is cash or

cash deposits. In the perspective of many users, stablecoins are equal to cash

because cash is liquid asset. However, none of the stablecoins other than USDT

are 100% cash. Stablecoins with high percentage of cash as underlying asset

might view as a better stablecoin to prevent bank run.